WAWF invoice automation can save a lot of time over entering them into the Wide Area Workflow website, particularly for DIBBS orders. This is especially true if the Receiving Report is submitted via Electronic Data Interchange (EDI). In such cases one simply adds an invoice number to the data and submits the invoice at the same time as the Receiving Report.

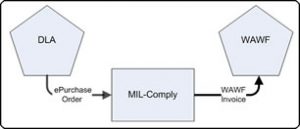

DIBBS contractors can take advantage of automatic shipment creation by importing electronic purchase order (EDI-850) transactions provided by DLA DIBBS. These orders can be converted into Receiving Report and Invoice transactions for EDI submission to WAWF at the same time driving Mil-Std-129 compliant container labeling.

Contractors may submit invoices electronically, bypassing use of the WAWF web site by creating electronic data interchange (EDI) transactions. Let us look at some methods of doing WAWF invoicing via EDI submission and see how MIL-Comply can speed and simplify this process.

WAWF Invoices may be created from CSV import files to automate your contract process.

DLA Contracts (Supply and Sustainment)

Companies processing purchase orders from DLA (DIBBS) can greatly simplify invoicing by using DLA electronic purchase order data to automatically create invoices. In most cases, WAWF invoicing of DLA orders (EDI X12-850) can be reduced to simply adding an invoice number and clicking a button. Even the creation of invoice numbers can be automated. For orders requiring RFID, MIL-Comply automates military standard labeling using that same data and submits the RFID data directly to WAWF. See DLA EDI-850 Purchase Order Processing for more information.

DCMA Contracts (Large Acquisitions)

DCMA managed contracts require invoice data to be handled at many stages of the labeling and shipping process, especially when RFID and UID requirements apply. Mil-Std-129 labels use much of the same data necessary to create a Receiving Report and WAWF Invoice. MIL-Comply collects that data, including RFID and UID, allowing electronic submission of a Receiving Report and WAWF Invoice without the inconvenience of connecting to the government web site.

Fast Pay

Fast Pay shipments do not require Contract Quality Assurance (CQA)for acceptance, but starting in January 2017, do require a Receiving Report to accompany the Invoice. MIL-Comply can automatically create Receiving Reports for Fast Pay Invoices. Simply select the Send Both option or the Combo transaction (if permitted by the contract). Fast Pay invoicing is mostly used in conjunction with DIBBS EDI Purchase Order Processing.

Cost Vouchers (Contract-related Costs)

The Cost Voucher, also referred to as a Public Voucher, is the means by which contractors may receive payment for costs incurred on cost-reimbursement type contracts. Formerly submitted as a paper SF1034/SF1035, the Cost Voucher must now be submitted through WAWF. Similar to the standard commercial invoices described above, Cost Voucher creation may be streamlined through the use of MIL-Comply WAWF tools. Business systems that maintain project cost data may easily import it into MIL-Comply to submit the invoice electronically, saving time and reducing errors.

2-in-1 Invoices (Services Only Contracts)

The 2-in-1 Invoice is normally submitted for service contracts that have no supply deliverables. It is similar to the WAWF Combo Invoice, used when a contract for services requires acceptance prior to submission of an invoice for payment.

Once submitted to WAWF the 2-in-1 creates a single internal Invoice/Receiving Report. The document is routed from the Vendor to the Acceptor, then to the Local Processing Office (LPO) if applicable, before it is routed to the Payment Office.

Business systems that maintain service invoice data may import it into MIL-Comply to create and perform WAWF invoicing electronically. The 2-in-1 invoice may be also be quickly created by hand, using MIL-Comply templates and item databases.

Progress Payment Request

Government contractors engaged in long-term fixed-price development contracts may incur considerable expense well before the first deliverable. Progress payments are a form of Government financing for such contracts that are provided in recognition of the need for working capital to pay for work in-process expenditures.

Formerly submitted on the SF1443 form, progress payments requests have become another type of WAWF invoice. Manual creation of Progress Payment requests can be eliminated by connecting MIL-Comply SF1443 Editor to your business systems.

Grant Vouchers (Invoicing on Non-Procurement Instruments)

The Grant Voucher is used to request funding for work done on Grants, Cooperative Agreements, Technology investment Agreements(TIA) and Other Transactions. Typically these are research projects performed by nonprofit entities, educational institutions and commercial organizations.

Similar to a Progress Payment Request, grant vouchers request payments in several installments over a period of time. The vendor populates the grant voucher from form SF270. This invoicing may be done in WAWF, or prepared in MIL-Comply and submitted electronically.

WAWF Automation Software

MIL-Comply is better and cheaper than using a WAWF invoicing service. Save money and gain more control by doing this simple process in-house.